Can anyone cut loss easily?

No, it is very hard due to emotion of Hope and Ignorance.

What are the factors that caused investor not willing to cut loss?

- not willing to accept the fact of their losing

- losing their hard-earned money

- overconfidence

- paper loss is okay for them as long as the losses yet realized

- 5 days of contra period yet fully utilized

To overcome the emotional of Hope and Ignorance as per below:

- having the correct mindset/ideology

- trade according trading rules

Mindset/Ideology

Mindset 1: Cut loss is a must.

Mindset 2: Cut loss at higher price so we can buy back more quantity with lower price with the residual capital.

Mindset 3: Cut loss is a capital protection.

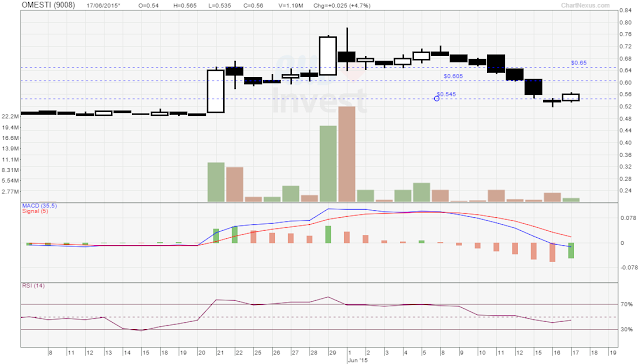

Example:

You bought ABC shares at point A RM0.50 10,000units, total RM5,000.00 (excluded charges). At the same time, you don't have extra cash to average down.

Scenario 1: Never cut loss.

When share price dropped 5% to the red line RM0.475, you continued hold without a cut loss strategy. (Paper loss RM250.00)

However, the share price yet rebound and dropped 20% from RM0.50 to point B RM0.40, your paper loss getting more and more. (Paper loss RM1000.00)

During RM0.40, do you have extra cash to buy in when you saw a rebound started at point B?

No, you don't have as you didn't cut loss earlier.

At the end, you sold at point C RM0.450. (Loss RM500.00)

Overall: -RM500 (NET LOSS)

Scenario 2: With cut loss strategy.

When share price dropped 5% to the red line RM0.475, you cut loss and get back RM4,750.00. (Loss RM250)

As the share price continued dropped to RM0.400, it doesn't matter as you had CUT LOSS and done your CAPITAL PROTECTION.

During RM0.400, you reenter with all RM4,750.00 and able to buy 11,800units.

When the share price reached RM0.450 and you sold it. (Profit RM590)

Overall: RM590 - RM250 = RM340 (NET PROFIT)

Summary

From above example, can you see how cut loss can save you from huge losses at the same time it provides the opportunity to cover back the losses incurred with profit.

Trading Rules

What are trading rules?

Trading rules are a guideline for you to buy and sell (take profit or cut loss).

Trading rules can be mixture of fundamental analysis (financial ratio, performance etc..), technical analysis (technical indicator signal, price movement etc...) and money management.

Every investor has different trading rules.

Example for money management trading rules:

Take profit if price up 30% from entry point.

Cut loss if price drop 10% from entry point.

Summary

In short, once you set your own trading rules then follow it and never goes against it.

Conclusion

When you having the right mindset with trading rules then emotional getting far from you and to achieve "WIN BIG, LOSS SMALL" is no longer a dream.

Thanks for your reading.

Hope above information is useful for you.

Disclaimer:

All posts and documents submitted by the Admin in this blog are solely for open discussion and education purposes only. All recommendations and opinion provided by the Admin are solely for your consideration only and you should exercise your own judgment in forming your own investment decision(s). Please also be informed that equity investment is risky and we recommend you to conduct sufficient searches for information in addition to referring our recommendations and/or opinion herein, prior to making an investment decision.

You should take full responsibility of your investment decision(s) and we accept no liability whatsoever for any direct or consequential loss arising from any use of our recommendations and/or opinion provided herein or any solicitations of an offer to buy or sell any securities. Comments and opinions forwarded/provided by members/followers of this blog do not belong to the Admin and we take no responsibility of such